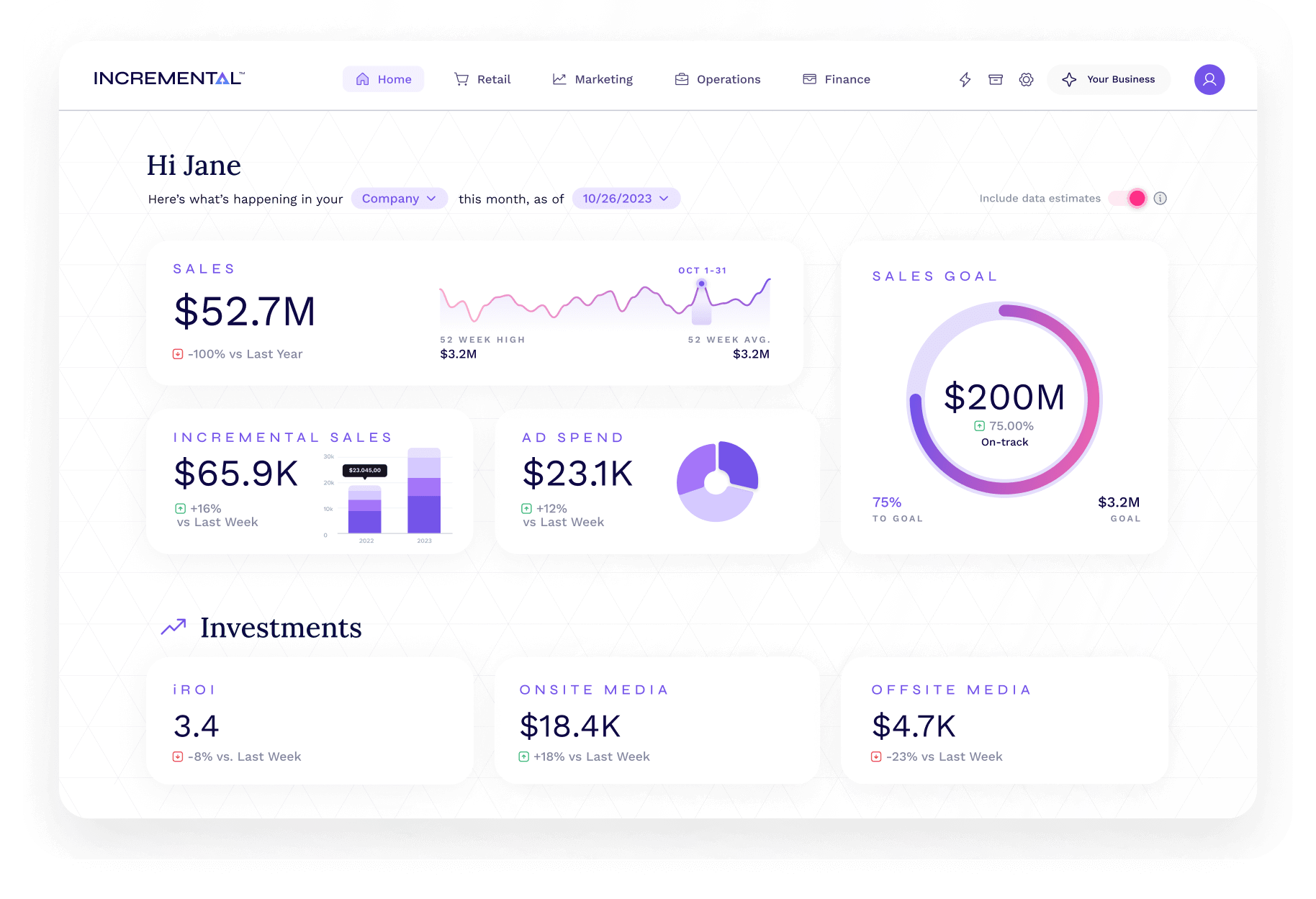

The New Standard in Retail Media

Unlock the Science of More with trusted, predictive, and actionable measurement.

Purpose-Built for Retail Media

It’s not just retail. It’s not just media. It’s retail media. Retail media buyers need a measurement platform that understands both. We purpose-built Incremental for this dynamic environment where pricing, promotion, placement, and product changes—alongside your media—in real time.

Incremental is a retail-aware platform that delivers measurement at the speed and granularity retail media buyers make decisions.

Your Business is Our Priority—Not Buying or Selling Media

You must trust that your measurement provider supports your business above everything else. If your measurement platform is motivated to sell you more ads, can you really trust it? Our company doesn't buy or sell any advertising, removing ourselves from any conflict of interest.

Incremental is your neutral retail media platform.

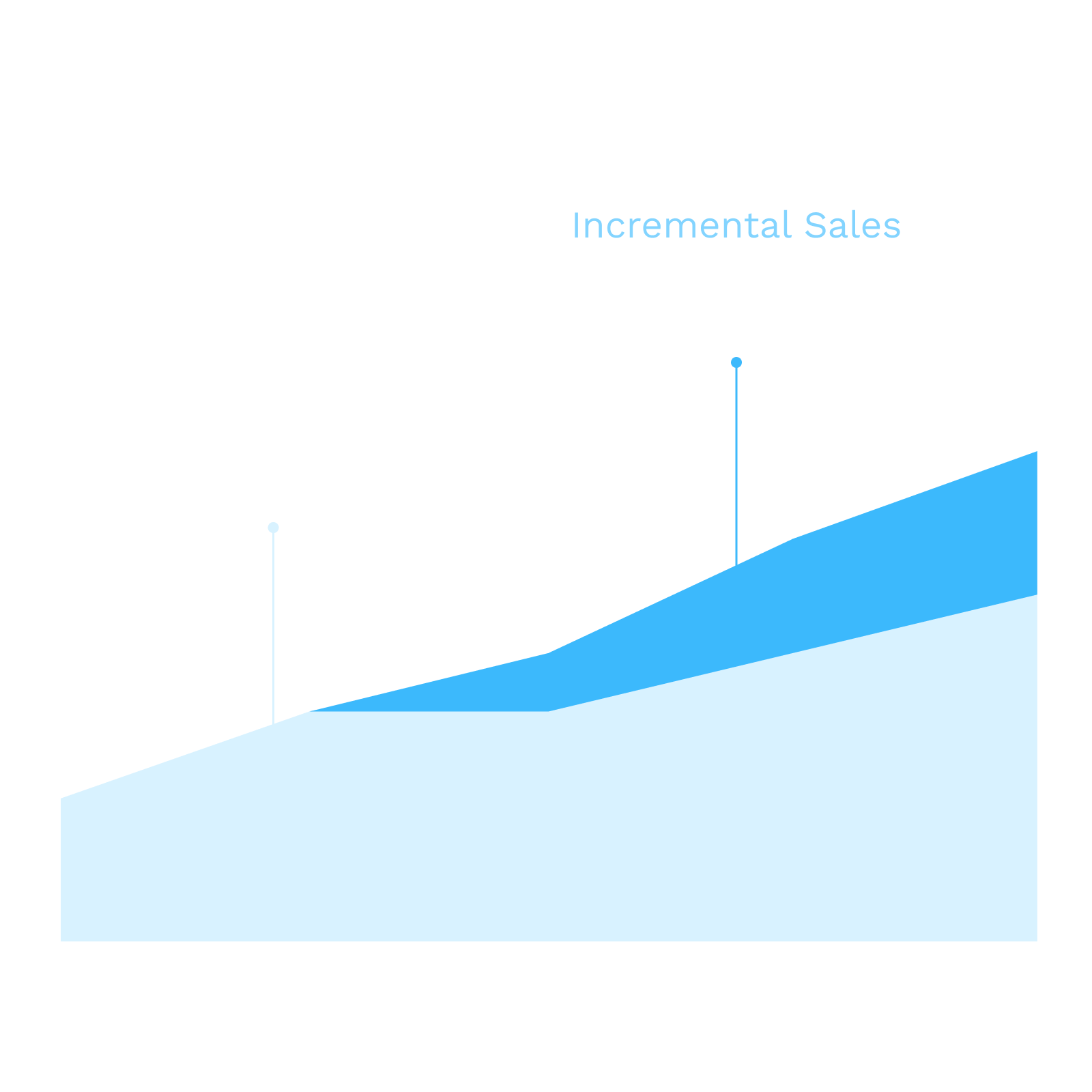

Measurement Beyond ROAS

Return on ad spend (ROAS) mistakes coincidence for causation, and hides the true impact of retail media campaigns. This means you may not be spending ad dollars where it really counts. Incremental controls for external factors, and generates easy-to-action recommendations to maximize profitable growth.

Get greater returns from your campaigns by optimizing towards incremental sales.

Consistent Measurement

Reporting across retail media networks is fragmented, with each using its own methodology to track performance. Incremental applies a consistent methodology across all your media, so you can compare the networks in one platform—apples to apples.

Get consistent measurement with Incremental.

Read Up on Retail Media

On the blog, learn about retail media strategies, and explore how businesses leverage Incremental to grow.

Browse the BlogDiscover Incremental Growth

Get a personalized demo—book a spot on our calendars today. (We’re ready when you are.)